Finance is a fundamental concept that plays a pivotal role in both our personal lives and the global economy. It refers to the management of money, assets, investments, and liabilities to achieve specific financial goals and ensure the efficient allocation of resources.

Finance is a multifaceted field that encompasses various aspects, each with its own unique characteristics and objectives. In this article, we will explore the different facets of finance, from personal finance to corporate finance, and delve into key finance terms, specialized branches, it's purpose, and promising career opportunities in the financial sector.

Personal Finance

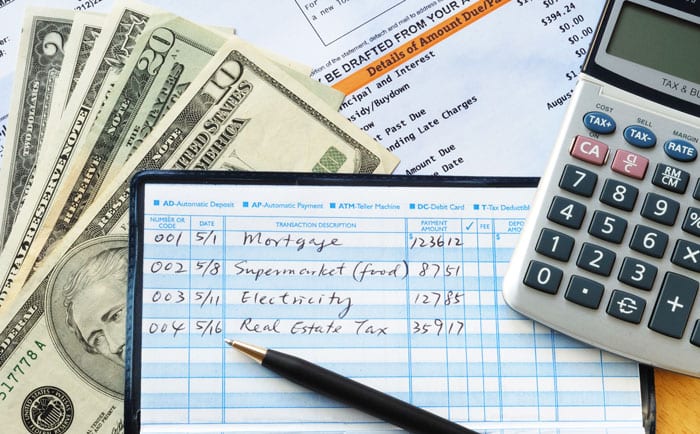

Personal finance is the cornerstone of financial well-being for individuals and households. It involves managing one's income, expenses, savings, and investments to achieve financial security and meet personal goals.

Here are some key aspects of personal finance:

- Budgeting: Creating a budget is the foundation of personal finance. It involves tracking income and expenses to ensure that spending aligns with financial goals.

- Savings: Saving money is essential to build an emergency fund, plan for major life events like buying a home, and secure your retirement.

- Investments: Wise investment choices, such as stocks, bonds, real estate, or mutual funds, can help grow wealth over time.

- Debt Management: Managing debt responsibly is crucial. This includes credit card debt, mortgages, student loans, and other liabilities.

Public Finance

Public finance deals with the management of government revenue, expenditures, and debt at various levels, including local, state, and national. It aims to allocate resources efficiently and ensure the economic stability of a nation.

Key aspects of public finance include:

- Taxation: Governments raise revenue through taxes, which are used to fund public services, infrastructure, and social programs.

- Budgeting: The government budget outlines planned expenditures and revenue sources, helping to prioritize public spending.

- Fiscal Policy: Governments use fiscal policy to influence economic growth and stability by adjusting tax rates and government spending.

Corporate Finance

Corporate finance focuses on managing the financial activities of businesses and organizations. It plays a crucial role in decision-making processes that impact a company's profitability and growth.

Key elements of corporate finance include:

- Capital Budgeting: Companies decide how to invest in projects, assessing potential risks and returns.

- Financial Reporting: Publicly traded companies must provide accurate financial statements to investors and regulators.

- Risk Management: Identifying and mitigating financial risks is vital to a company's long-term success.

- Capital Structure: Companies determine the mix of debt and equity financing to optimize their cost of capital.

Key Finance Terms

Before diving deeper into finance, it's essential to understand some fundamental terms:

- Asset: Anything of value owned by an individual, company, or organization, such as cash, real estate, stocks, or bonds.

- Liability: Financial obligations or debts that must be repaid, including loans, mortgages, and credit card balances.

- Interest: The cost of borrowing money or the return earned on investments.

- Portfolio: A collection of investments held by an individual or organization.

- Diversification: Spreading investments across different asset classes to reduce risk.

Other Types of Finance (Social Finance, Behavioral Finance, and International Finance)

Finance is a dynamic field that continually evolves to address changing economic and societal needs. Here are some specialized branches of finance:

- Social Finance: This focuses on investments that generate both financial returns and positive social or environmental outcomes, often referred to as impact investing.

- Behavioral Finance: This branch explores the psychological factors influencing financial decisions and how emotions can affect investment choices.

- International Finance: It deals with financial transactions and investments across borders, taking into account currency exchange rates and geopolitical factors.

Purpose of Finance

The overarching purpose of finance is to facilitate the flow of money and resources in ways that benefit individuals, organizations, and society as a whole. Here are some key objectives:

- Resource Allocation: Finance helps allocate resources to their most efficient uses, promoting economic growth and development.

- Risk Management: Finance provides tools and strategies to manage and mitigate financial risks, ensuring stability.

- Wealth Creation: Through investments and prudent financial planning, finance empowers individuals to build wealth over time.

- Sustainability: Sustainable finance promotes environmentally responsible investments and practices to address global challenges.

Top Finance Careers

The field of finance offers a wide array of career opportunities for individuals with various interests and skills. Here are some of the top finance jobs:

- Financial Analyst: Analyzing financial data to provide insights and recommendations for investment decisions.

- Investment Banker: Assisting companies in raising capital through the issuance of stocks and bonds, as well as providing merger and acquisition advisory services.

- Financial Planner: Helping individuals and families create comprehensive financial plans, including retirement and estate planning.

- Accountant: Managing financial records, preparing tax returns, and ensuring compliance with financial regulations.

- Risk Manager: Identifying and assessing potential financial risks for organizations and developing strategies to mitigate them.

- Financial Consultant: Offering expert advice on various financial matters, often as an independent advisor or within a financial firm.

In conclusion, finance is a multifaceted discipline that encompasses personal finance, public finance, and corporate finance, each serving distinct purposes in our lives and the broader economy. Understanding key finance terms and exploring specialized branches like social finance, behavioral finance, and international finance can provide valuable insights into this dynamic field. Whether you aspire to manage your own finances or pursue a career in finance, the knowledge and skills you gain will empower you to make informed financial decisions and contribute to economic growth and stability.

Here Are Some Frequently Asked Questions (FAQs) Related To Finance

What is finance, and why is it important?

Finance is the management of money, assets, investments, and liabilities to achieve financial goals and allocate resources efficiently. It's important because it impacts both personal financial well-being and the global economy. Without effective finance, individuals, businesses, and governments can face financial instability.

What are the key components of personal finance?

Personal finance includes budgeting, savings, investments, debt management, and financial planning for individuals and households. It's about making informed decisions to achieve financial security and reach long-term goals.

How does public finance affect me as a taxpayer?

Public finance involves government revenue, spending, and debt management. It affects taxpayers by determining how tax money is used to fund public services, infrastructure, and social programs, impacting the quality of life and economic stability of a region or nation.

What are the main functions of corporate finance?

Corporate finance involves capital budgeting, financial reporting, risk management, and capital structure decisions. These functions help businesses make financial decisions that impact profitability, growth, and sustainability.

What are some common finance terms I should know?

Essential finance terms include assets (items of value), liabilities (financial obligations), interest (cost of borrowing or return on investments), portfolio (collection of investments), and diversification (spreading investments to reduce risk).